|

Visalia, CA Estate Planning Blog

Tuesday, June 10, 2014

7576.jpg)

Medicare vs. Medicaid: Similarities and Differences

Although the American healthcare system has undergone some changes recently, most of the existing programs are still an integral part of the way people receive medical treatment. But even though most people are familiar with the names "Medicare" and "Medicaid", many often mistake these programs for one another, or presume the programs are as similar as their names.

While both are government-run programs, there are many important differences. Medicare provides senior citizens, the disabled and the blind with medical benefits. Medicaid, on the other hand, provides healthcare benefits for those with little to no income.

Overview of Medicare

Medicare is a public health insurance program for Americans who are 65 or older. The program does not cover long-term care, but can cover payments for certain rehabilitation treatments. For example, if a Medicare patient is admitted to a hospital for at least three days and is subsequently admitted to a skilled nursing facility, Medicare may cover some of those payments. However, Medicare payments for such care and treatment will cease after 100 days.

In summary:

- Medicare provides health insurance for those aged 65 and older

- Medicare is regulated under federal law, and is applied uniformly throughout the United States

- Medicare pays for up to 100 days of care in a skilled nursing facility

- Medicare pays for hospital care and medically necessary treatments and services

- Medicare does not pay for long-term care

- To be eligible for Medicare, you generally must have paid into the system

Overview of Medicaid

Medicaid is a state-run program, funded by both the federal and state governments. Because Medicaid is administered by the state, the requirements and procedures vary across state lines and you must look to the law in your area for specific eligibility rules. The federal government issues Medicaid guidelines, but each state gets to determine how the guidelines will be implemented.

In summary:

- Medicaid is a health care program based on financial need

- Medicaid is regulated under state law, which varies from state to state

- Medicaid will cover long-term care

Even if you are not a part of the demographics that these programs serve, it's extremely likely that you know someone who is, and so it's a good idea to understand their function. Looking ahead to your future healthcare options and their legal implications is an essential element of estate planning, and a big part of the guidance that I offer my clients. For more information on planning for your wellness and that of the ones you love, please give me a call for your free consultation!

Tuesday, June 3, 2014

7114.jpg)

Every year, each individual who dies in the U.S. can leave a certain amount of money to his or her heirs before facing any federal estate taxes. For example, in 2014, a person who died could leave $5.34 million to his or her heirs (or a charity) estate tax free, and everything over that amount would be taxable by the federal government. Transfers at death to a spouse are not taxable.

Therefore, if a husband died owning $8 million in assets in 2014 and passed everything to his wife, that transfer was not taxable because transfers to spouses at death are not taxable. However, if the wife died later that year owning that $8 million in assets, everything over $5.34 million (her exemption amount) would be taxable by the federal government. Couples would effectively have the use of only one exemption amount unless they did some special planning, or left a chunk of their property to someone other than their spouse.

Estate tax law provided a tool called “bypass trusts” that would allow a spouse to leave an inheritance to the surviving spouse in a special trust. That trust would be taxable and would use up the exemption amount of the first spouse to die. However, the remaining spouse would be able to use the property in that bypass trust to live on, and would also have the use of his or her exemption amount when he or she passed. This planning technique effectively allowed couples to combine their exemption amounts.

For the year 2014, each person who dies can pass $5.34 million free from federal estate taxes. This exemption amount is adjusted for inflation every year. In addition, spouses can combine their exemption amounts without requiring a bypass trust (making the exemptions “portable” between spouses). This change in the law appears to make bypass trusts useless, at least until Congress decides to remove the portability provision from the estate tax law.

However, bypass trusts can still be valuable in many situations, such as:

(1) Remarriage or blended families. You may be concerned that your spouse will remarry and cut the children out of the will after you are gone. Or, you may have a blended family and you may fear that your spouse will disinherit your children in favor of his or her children after you pass. A bypass trust would allow the surviving spouse to have access to the money to live on during life, while providing that everything goes to the children at the surviving spouse’s death.

(2) State estate taxes. Currently, 13 states and the District of Columbia have state estate taxes. If you live in one of those states, a bypass trust may be necessary to combine a couple’s exemptions from state estate tax.

(3) Changes in the estate tax law. Estate tax laws have been in flux over the past several years. What if you did an estate plan assuming that bypass trusts were unnecessary, Congress removed the portability provision, and you neglected to update your estate plan? You could be paying thousands or even millions of dollars in taxes that you could have saved by using a bypass trust.

(4) Protecting assets from creditors. If you leave a large inheritance outright to your spouse and children, and a creditor appears on the scene, the creditor may be able to seize all the money. Although many people think that will not happen to their family, divorces, bankruptcies, personal injury lawsuits, and hard economic times can unexpectedly result in a large monetary judgment against a family member.

Although the changeable nature of bypass trusts may seem complicated and confusing, there are still many situations in which they can be invaluable tools to help families avoid estate taxes. Is your family one of them?

Tuesday, May 27, 2014

4707.jpg)

Many people own a family vacation home--a lakeside cabin, a beachfront condo--a place where parents, children and grandchildren can gather for vacations, holidays and a bit of relaxation. It is important that the treasured family vacation home be considered as part of a thorough estate plan. In many cases, the owner wants to ensure that the vacation home remains within the family after his or her death, and not be sold as part of an estate liquidation.

There are generally two ways to do this: Within a revocable living trust, a popular option is to create a separate sub-trust called a "Cabin Trust" that will come into existence upon the death of the original owner(s). The vacation home would then be transferred into this Trust, along with a specific amount of money that will cover the cost of upkeep for the vacation home for a certain period of time. The Trust should also designate who may use the vacation home (usually the children or grandchildren). Usually, when a child dies, his/her right to use the property would pass to his/her children.

The Cabin Trust should also name a Trustee, who would be responsible for the general management of the property and the funds retained for upkeep of the vacation home. The Trust can specify what will happen when the Cabin Trust money runs out, and the circumstances under which the vacation property can be sold. Often the Trust will allow the children the first option to buy the property.

Another method of preserving the family vacation home is the creation of a Limited Liability Partnership to hold the house. The parents can assign shares to their children, and provide for a mechanism to determine how to pay for the vacation home taxes and upkeep. An LLP provides protection from liability, in case someone is injured on the property.

If you or someone you know has questions about how to best protect and preserve a vacation home for future generations, please give me a call or make an appointment in the sidebar to the left. Your first consultation is free of charge for all your estate planning enquiries.

Happy vacationing!

Wednesday, May 21, 2014

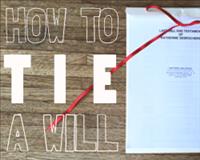

If you’ve never heard of the process of “tying a Will”, you are definitely not alone. Tying a Will is an ancient method of finishing off a legal document that was once widely used, though is rather rare today. But that rarity and time-honored sense of the ceremonial is exactly what I love about this process, and why I have decided to introduce it as the finishing flourish to your estate plan: it’s my way of showing a nod of respect to this important step in your life.

As the name suggests, in this procedure the Will is literally "tied" together with ribbon, just after the signing and notarization. The ends of the ribbon are then sealed just below the signature. In addition to providing a special look and sense of formality, tying and sealing the Will functions as an extra security measure that prevents anyone from removing pages, or otherwise tampering with the finished Will.

This method has been used since ancient times, and can be found as one of the earliest uses of personal and governmental wax seals. Tying and sealing was the first and primary method of document security and can be observed as an enduring tradition in just about every major civilization on the globe.

The imprint of a seal serves two major purposes of security. The first is that a seal imprint indicates that the creator of the document was present at the time of the document’s tying and sealing. The second is that a seal is meant to be applied in such a way as to indicate tampering if broken. That is why seals were (and still are) applied to the outsides of envelopes: if the seal is broken, you know that someone has been reading your mail. And in the case of our tied and sealed Wills, if the seal is broken, you know that someone has tampered with the ribbons which tie your Will together.

Seals are highly personal; on par with an individual’s signature. The use of a seal is by no means extinct either. Although the use of wax and classic intaglio seals has largely given way to ink stamps or foil stickers, seals are still widely used as a method of authentication for documents (particularly legal ones). In many parts of the world, including America, Central/Eastern Europe, and East Asia, a signature alone is often considered insufficient to validate a business or legal document.

Given the historical importance and ceremonial beauty, I can see no better way to salute your estate planning efforts than by tying and sealing your Will; a tradition that stands the test of time.

Interested in learning to tie a Will yourself? Here are some simple step-by-step instructions for the process. And of course, if you are interested in creating your own Will, please feel free to make an appointment for your free consultation today. Just click the link on the left, or call the number above.

Happy tying!

Tuesday, May 13, 2014

6424.jpg)

Many people erroneously assume that when one spouse dies, the other spouse receives all of the remaining assets; this is often not true and frequently results in unintentional disinheritance of the surviving spouse.

In cases where a couple shares a home but only one spouse’s name is on it, the home will not automatically pass to the surviving pass, if his or her name is not on the title. Take, for example, a case of a husband and wife where the husband purchased a home prior to his marriage, and consequently only his name is on the title (although both parties resided there, and shared expenses, during the marriage). Should the husband pass away before his wife, the home will not automatically pass to her by “right of survivorship”. Instead, it will become part of his probate estate. This means that there will need to be a court probate case opened and an executor appointed. If the husband had a will, the executor would be the person he nominated in his will who would carry out the testator’s instructions regarding disposition of the assets. If he did not have a will, state statutes, known as intestacy laws, would provide who has priority to inherit the assets.

In our example, if the husband had a will then the house would pass to whomever is to receive his assets pursuant to that will. That may very well be his wife, even if her name is not on the title.

If he dies without a will, state laws will determine who is entitled to the home. Many states have rules that would provide only a portion of the estate to the surviving spouse. If the deceased person has children, even if children of the current marriage, local laws might grant a portion of the estate to those children. If this is a second marriage, children from the prior marriage may be entitled to more of the estate. If this is indeed the case, the surviving spouse may be forced to leave the home, even if she had contributed to home expenses during the course of the marriage.

Laws of inheritance are complex, and without proper planning, surviving loved ones may be subjected to unintended expense, delays and legal hardships. If you share a residence with a significant other or spouse, I invite you to come and talk to me so I can help you determine the best course of action after taking into account your unique personal situation and goals. There are simple ways to ensure your wishes are carried out and avoid having to probate your partner’s estate at death. Ironing out these kinds of details is what good estate planning is all about. Call or make an appointment online for your no-cost estate planning consultation with me. I'm happy to answer your questions, and set you on the right track.

Monday, May 5, 2014

This is the final installment of our five-part email campaign to get the word out identifying the ten most common mistakes regarding guardianship nominations made by parents in estate planning. If you have been following this campaign, then congratulations! You now know the most important do’s and don’ts that will benefit a young family when planning for their estate. But even if you haven’t been with us since the beginning, we’ve got you covered: (for #1-2 click here, #3-4 click here, #5-6, clickety, #7-8, clickety-click).

Our core subject: What would happen to the kids if something happened to you? You now know how important attention to detail is when developing your estate plan, and you know there is much more to consider than most planners advise. It is often the simplest, most obvious-seeming considerations that are missed when guardianship planning is undertaken. And you know that I am here to help you avoid the 10 mistakes I have identified; with careful planning tailored specifically to you, and the ones you love. (Oh, and did I mention that I will do this for you young parents at no cost! Please read on…)

On to the final two mistakes!

Mistake #9: The ninth mistake is not using a stand-alone guardian nomination document, but rather, putting limited instructions in a Will. When planning for minor children, one of the things I stress is the creation of a stand-alone guardianship nomination. I do this because such a document makes it easier and clearer to identify and address all the details we have been talking about. As we’ve discovered, it is identifying your wishes, your beliefs, your preferences, your choices, your parenting plan for your children in a guardianship nomination document, providing details for your chosen guardian to pass on to your children. And so I prefer to create the document that deals exclusively with those details as a way to honor your legacy.

Mistake #10: The tenth and final mistake I have identified is having no clear instructions for caregivers or guardians. I can see no reason not to be completely thorough when planning a guardianship nomination. Think about all the decisions you make for your child’s well-being every day; there are hundreds! And though you can’t use guardianship planning to legislate every minute of your child’s life, there are some very important markers that are worth outlining for your chosen guardian, i.e.; your customs, traditions, religious beliefs, education preferences, arts, literature, music…etc. It is okay to be specific.

I understand that people avoid thinking about elements of estate planning such as naming guardians, deciding on beneficiaries and division of estates, etc., primarily because this involves facing our mortality. Thinking about death. Not fun! So we wait until disaster strikes, like illness. Or, worse, we completely blow it, and face an unexpected death, and leave loved ones to deal with the harsh and public process of court probate. So, really, death without planning is worse than taking a moment now and thinking it through. Putting in place the protections that are available through proper and comprehensive estate planning is responsible. It is liberating. It provides peace of mind. At our office, we respect the seriousness of the issues at hand, but we lighten it up! We strive to make it fun. Our comprehensive estate plan includes “goodies” such as: a ceremonial signing wherein we “tie” the will (an old-school process we are bringing back as a gesture of respect). We provide an executive binder holding all documents, a personalized flash drive holding pdf copies of all executed original documents, a memorial planner, and we place all items in a tote bag, printed with custom artwork designed by Katherine Desrochers, and inspired by the poem by Ralph Waldo Emerson “The Key To A Successful Life.” (click here for more on that poem and our philosophy).

To all young parents and those who care about them, thank you for letting me share these 10 mistakes with you. I hope that this has been informative for you, and inspirational in helping you plan your estate around your most valuable asset of all: your family.

Tuesday, April 29, 2014

Hi everyone! We’ve made some great progress in identifying the ten most common mistakes made regarding guardianship nominations in estate planning. I have just four left to share with you. The subject: What would happen to the kids if something happens to you? Lets examine. (if you missed the first 6, click here).

Mistake # 7: The seventh mistake I have identified is naming guardians only for the long term. When most people think about choosing a guardian if something happened to them, they are considering who they would want to care for their children for the rest of the foreseeable future. But deciding on a short-term guardian is also absolutely essential. Think about it: suppose you’ve named your brother and his wife as guardians, but they live in Florida? If something happened to you, who would care for your children in the time it would take to contact your brother and for him to arrive here in California? Child Protective Services (the state) could place the children in short-term care. This could mean foster care with a stranger! The event of something happening to you would be traumatic enough for your children. They would need to be with someone they know, living here, and right now. You would want someone you trust, someone with whom your kids are comfortable to help them through those terrible first few hours/days before their long-term guardian is on the scene. It is a small window of time over which to appoint a guardian, but when you think about it, it is a crucial one.

Mistake # 8: (Another “biggie”)… not notifying people who are named as guardians. This seems rather logical, but again, it is surprising how often those nominated as guardians remain un-notified. In many cases, parents simply don’t wish to bring up what can feel like (okay…IS) an unpleasant subject. But when you think about it, notifying your chosen guardian(s) is a very important thing to do. Firstly, it is a good idea to let them know that they’ve been chosen, just to make absolutely certain that they feel comfortable with this role. AND talking about this appointment is an excellent opportunity to start deepening your relationship with your chosen guardian; involving them more in the lives of your children, and strengthening the bond between all of you. Even if your guardian never needs to assume that role, this conversation is an excellent way to take your relationship to a newer, more meaningful level.

Remember: it’s the examination of seemingly small details like these that makes a meaningful guardianship plan for your children. I understand that thinking about these things can be difficult, but let’s just do it! Let’s get it done. You have nothing to lose and everything to gain, because I will walk with you and help you plan this out. I will draft your guardianship nominations at no charge. I will answer any questions you may have about estate planning, free of charge or obligation. Call me. Book an appointment online. Plan it forward!

Click here to read about mistakes #9 and #10.

Sunday, April 27, 2014

Hello fellow parents! Joan Watters here, continuing to share with you the ten most common mistakes made regarding guardianship nominations in estate planning (if you missed 1-4, click here). The subject: What would happen to the kids if something happened to you? Let's examine the fifth mistake I have identified:

Mistake #5: not using a Trust to handle assets.

Many parents –particularly young ones who are still building their wealth- are under the impression that a simple Will is all they need to address their estate planning needs. A common misconception is that a Trust is an Estate Planning tool reserved for the very wealthy. But if you have minor children, a Revocable Living Trust is often a very good option. There are many reasons for this, but the main one is that when you put your assets into a Trust, your estate avoids probate. As you may know, probate is a long, expensive, and rather exhaustive, process over which the court presides. If something happens to you and your estate is subjected to probate, your loved ones and chosen guardian (have you chosen one?) are stuck dealing with this unpleasant process. And what’s more, the resources you have left behind will be tapped into by the probate process, and take far longer to be allocated to your guardian and children. With a Trust-based plan, your assets (including your family home) are available to your children and their guardian almost immediately.

Mistake #6: Biggie.

This sixth mistake I have identified is kind of a biggie. Many Estate Planning attorneys are accustomed to helping their clients name a guardian. But most of the time, no one thinks about excluding who you do NOT want to serve as a guardian for your children; no matter what happens.

Here is an excellent example of what can happen if you fail to take this sort of thing into account: a colleague of mine has two sisters. One is young, still in her twenties. She travels a lot, and hasn’t really settled down in her career yet. She is not married, is carefree, and likes to have a good time (parties!). On the other hand, my colleague’s other sister is in her early thirties, has a stable career, and has been married for a number of years with children of her own. Now, if guardianship were left up to the courts, the older sister might seem like the best choice. But it is my colleague (and not the courts) who knows that she would never want her older sister raising her kids. That is because she knows her older sister’s marriage and home life are frankly toxic, and they do not see eye-to-eye on parenting styles at all. Whereas even though on paper the younger sister looks unprepared for guardianship, my colleague knows without a doubt that she would rise to the challenge and commitment of guardianship, and devote her life entirely to my colleague’s children. They share the same values.

Again, these things seem simple and intuitive when I mention them, but I never stop being surprised at how many estate plans and guardianship nominations fail to address these essential concerns. Well, not on my watch. I am devoted to fixing this oversight. I “walk the walk.” Call me and I will work with you young parents to draft a protective guardianship nomination, for no cost or obligation, and I will also answer any and all of your questions about estate planning. I love what I do, and I enjoy empowering young parents with this information.

Click here to read about mistakes #7 and #8.

Thursday, April 17, 2014

Hello everyone, Joan Watters here.

As you may have heard, I am on a mission: to fix common mistakes made by families when it comes to estate planning and asset protection. This email is my second installment in a 5-part message campaign to get the word out to young parents, and to fix the Ten Most Common Mistakes made when planning for the needs of families and their estates. If you are just joining us, welcome! To see the first installment,"Mistakes #1 and #2" please click here.

I was recently described as "The estate planning attorney to go to, especially for young families" This was a very "feel good" remark for me, as I truly love what I do. My focus on providing legal advice to young families is personally rewarding, as it gives me the opportunity to meet and get to know young parents (who often bring their delightful infants along with them). It's perfect; I bring my estate planning expertise to the table, and my young parents bring their kids to the table!

Then we get down to business. Important family (asset) protection is reviewed, (at a no-cost informational consultation) and relevant essential documents are prepared (including a no-cost first basic document...more on that later). These young families become part of my family; my estate planning family.

Last week, we discussed how it is an essential consideration for young parents to name and nominate guardians for their children. In the event something were to happen to you, a judge could very well name someone you would never choose. DO NOT LET THE STATE DECIDE FOR YOU. Let me help you take control today. You are invited to meet with me for a no-cost informational meeting on estate planning and essential legal documents. You can book an appointment online, right here.

But now, lets move on to this week's focus: Mistakes #3 and #4.

The third mistake is only naming one possible guardian.

While the choice of a guardian requires much thought and consideration (and the emphasis should be on matching someone to your lifestyle and parenting philosophy model), it is beneficial to consider and name an alternative choice should the first named individual (or couple) be unavailable or unwilling when and if the need arises. (I call this "contingency planning").

The fourth mistake is not organizing financial resources for the use of the guardian.

Many people are under the impression that the best guardian to name is the one that has the most financial resources. But we all know that money doesn't necessarily make a good parent. With proper estate planning, you can leave assets or organize a life insurance policy for the benefit of your children. (I don't sell life insurance, but I will give you some great names for your consideration...personally pre-screened!).

My course of action is to help you get organized with your essential estate planning considerations, coach you on what legal documents are important and why, (wills, trusts, health care directives, etc.) to help you name and nominate guardians best matched to your parental skills and philosophies...and to give you a gift. I will prepare that first (and most important) basic document: your guardian nomination document free of charge. Just call me at 559 635-1775, or visit my website for more information.

Be sure to stay tuned for our next installment... Mistakes #5 and #6 are coming next week!

Thursday, April 10, 2014

This entry is part one of my five-part message campaign The Ten Most Common Mistakes made when planning for the needs of families and estates.

As an estate planning attorney (and parent), it is my desire to help young families figure a few things out, and then prepare essential legal documents. To make this easy, I provide a no-cost informational consultation regarding all aspects of estate planning, and for young parents: a no-cost first basic guardianship document.

MISTAKE #1: The first (and biggest) mistake I see in estate planning for young families is not choosing a guardian properly (or at all!).

69% of parents have not named guardians. Why? Because most parents are unaware of their options, or simply cannot decide whom to choose (or even worse, they decide not to decide!).

So let’s begin with a discussion on guardianship nominations. This is not a simple topic, not a simple decision, and not a simple thing to get your head around. Yet it is so important to ask: “Who would be the best choice to care for your children if something were to ever happen to you?”

And guess what? The best guardian choice may not be your parents or siblings (even if you may feel obligated to name them). Your best choice may also not be the friend or family member that has the most money. In fact, when naming a guardian, the thing you should focus on the most is your parenting priorities (such as residence, location, religion, personal philosophies, cultural interests, legacy information, etc.), and then ask who among your guardian choices could best instill those priorities in your child(ren)?

If you have minor children, choosing a guardian is absolutely essential (if something happens to you and you have not named a guardian, the State will choose for you!) Can you see grandparents dueling it out in court? Or the Judge selecting someone you would NEVER choose? Not a good idea.

For young parents, I will help you navigate and solve these issues at no charge.

MISTAKE #2: The second mistake that I see young parents making is to name a couple to serve as guardian without considering what would happen if one half of the chosen couple were to die (or if they got a divorce!).

It’s pretty simple: just ask yourself, if one half of this couple were gone, would I want the other one to take care of my child(ren) alone? So name both, but let’s provide for a contingency plan should they separate or if one were to predecease the other.

So WHO is the person (or persons) that you would choose to be responsible for taking care of your children’s physical, emotional and spiritual needs if you aren’t there to do it yourself?

Let me help you make these decisions and draw up the legal documents that will demonstrate your intentions. Protecting kids is a subject close to my heart. I love what I do as an estate planning attorney, and I enjoy working with our community’s wonderful young parents. I will answer any and all questions you may have about estate planning, wills, trusts, health care directives, etc. Call me for a no-cost consultation at (559) 635-1775.

P.S. Stay tuned for my next entry…Mistakes #3 and #4 (these are BIG).

Monday, April 7, 2014

As an Estate Planning Attorney, it is my job to create estate plan documents best suited for your family’s needs. And as a mom (my favorite job), protecting kids is a subject that is very close to my heart. So my natural maternal instinct combined with my estate planning experience draws me to young families; to help them figure things out. But more often than not, I find that parents have little or no information regarding even basic legal documents. I want to fix this. (To make it easy, I provide a no-cost informational consultation, and for young parents, a no-cost first basic document …but more on that later).

I have identified ten of the most common mistakes made when planning for the needs of families and estates. This month I’d like to share these with you and offer you solutions to avoid these kinds of errors; so you can protect the ones you love.

I have created a 4-part message campaign this month to get the word out to young parents. So please, pass it on.

Over the years, I have noticed that not only do many young parents fail to have any estate planning in place, but even those that have created a Will or a Trust are often left wildly under-assisted with guardianship nominations and legacy details; important components of estate planning that define the sort of life their children should have.For example, when I ask a young parent: “What would happen to your kids if you didn’t make it home one day?” I note that few have given this enough thorough (or any) reflection. Understandably; it is a hard question. It’s against our nature to think about death or our mortality, and so we avoid these thoughts. Let’s think about that tomorrow. But the truth is… this kind of thinking leaves our kids unprotected.

Your child’s safety and happiness is something that affects every decision a young parent makes. From what car seat to select, to what school they will attend, to what they have for dinner…so many routine things require such careful consideration.

But these choices are easy -and perhaps even fun- to make when compared to the most important (and most difficult) decision of all: thinking through the outcome of what your child’s life would be like if something happened to you, and then drafting and providing clear, thoughtful instructions as to the life you would want for your child if you cannot be there.

So, WHO is the person that you would choose to be responsible for taking care of your children’s physical, emotional and spiritual needs if you aren’t there to do it yourself?

Helping you execute these crucial decisions is where I come in.

Go to www.itrustlaw.com and schedule a no-cost consultation, or call me directly at (559) 635-1775 to schedule an appointment. If you or someone you know is a young parent, please contact me to arrange for the preparation of your first basic document: a FREE guardianship nomination prepared for use in the event of necessity, which will establish your clear intentions, and your choices as to who will raise your children if you cannot be there.

Located in Visalia CA, Joan A. Watters, Esq. Attorney at Law assists clients throughout the Central Valley of California with various estate planning and elder law. Areas include but are not limited to Visalia, Exeter, Tulare, Hanford, Bakersfield, Lemoore, Three Rivers; and the surrounding counties of Tulare, Kings, and Kern.

|

|

|

|